Johannesburg – JSE-listed Aspen Pharmacare Holdings Limited (APN), a global multinational specialty pharmaceutical company, has reported creditable unaudited interim Group financial results for the six months ended 31 December 2022.

Salient Highlights

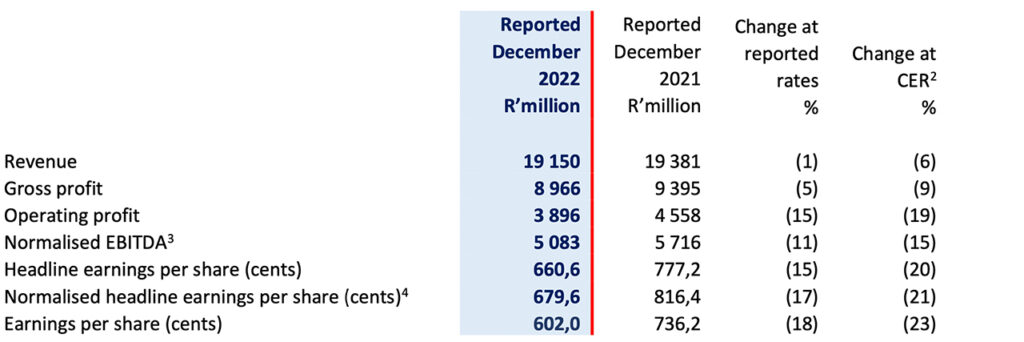

- Revenue decreased by 1% (-6% in constant exchange rate (“CER”)) to R19,2 billion (December 2021: R19,4 billion)

- Normalised EBITDA decreased by 11% (-15% in CER) to R5,1 billion (December 2021: R5,7 billion)

- Normalised headline earnings per share decreased by 17% (-21% in CER) to 679.6 cents (December 2021: 816.4 cents)

- Headline earnings per share decreased by 15% (-20% in CER) to 660.6 cents (December 2021: 777.2 cents)

- Earnings per share decreased by 18% (-23% in CER) to 602.0 cents (December 2021: 736.2 cents)

- Improved Commercial Pharma gross profit margins helped deflect inflationary headwinds

- Significant advances have been made in contract negotiations with multinational customers seeking to secure a portion of Aspen’s sterile manufacturing capacities

- The technical transfer project for manufacture of the finished dose form vaccines licensed from Serum Institute of India is well advanced

Stephen Saad, Aspen Group Chief Executive said, “The Group’s performance under challenging trading conditions was anticipated and is aligned to guidance previously shared for the first half of the financial year. Consistent with our previous communications, we are optimistic that the results for the second half of this financial year will not only exceed those reported for the first half but will also exceed those of the second half of the prior year. We are pleased to report that we are at advanced stages of contract negotiations to fill a portion of the additional sterile manufacturing capacities we have developed. Once concluded, this new manufacturing business is anticipated to realise a contribution of R2 billion in the 2024 calendar year, increasing to R4 billion in calendar year 2025. During the second half of this financial year we also anticipate closing important product portfolio transactions which will further enhance the Commercial Pharmaceuticals businesses in Latin America and South Africa.”

GROUP HIGHLIGHTS

Key Financial Indicators1

GROUP PERFORMANCE

The Group has delivered a creditable and resilient performance under challenging trading conditions. As previously guided, relative to the prior comparative period, this half was impacted by the Russian/Ukraine war, inflationary pressure, COVID lockdowns and volume-based procurement impacts in China as well as the loss of COVID vaccine sales. These headwinds had some offsets from improved margins in Commercial Pharmaceuticals.

Group revenue for the six months ended 31 December 2022 declined by 1% (-6% CER) to R19 150 million with Commercial Pharmaceuticals revenue growing 2% (-4% CER). Manufacturing revenue declined by 10% (-12% CER). Gross profit fell by 5% (-9% CER) as the reduction in Manufacturing gross profit margins from lost COVID vaccine contributions more than offset the improvement in Commercial Pharmaceuticals gross profit margins. Normalised EBITDA recorded negative growth of 11% (-15% CER) at R5 083 million. Lower net interest costs partly mitigated the increase in net financing costs arising from net foreign exchange losses of R234 million following the weakening of emerging market currencies. NHEPS declined by 17% (-21% CER) to 679,6 cents.

The Group’s leverage ratio remained comfortably below target levels with reported net borrowings of R18,8 billion. During this period of uncertainty, given the war in Ukraine and COVID related supply impacts, there was increased investment in inventory by the Manufacturing segment. We have sufficient confidence to substantially unwind this working capital investment in the second half of the financial year.

Aspen successfully concluded agreements with each of the Bill & Melinda Gates Foundation (“the Gates Foundation”) and the Coalition for Epidemic Preparedness Innovations (“CEPI”) to support African regional manufacturing capacity for an affordable supply of vaccines.

Important advances were also made in the negotiation of key manufacturing contracts.

SEGMENTAL PERFORMANCE (AT CER)

Commercial Pharmaceuticals

Commercial Pharmaceuticals revenue, comprising Regional Brands and Sterile Focus Brands, declined by 4% to R14 547 million. Revenue was negatively impacted, primarily by the divestment of certain products in South Africa in March 2022 as well as by the challenges documented earlier. The improved gross profit margin percentage resulted in a lower decline in gross profit of 2% to R8 728 million.

Regional Brands

Revenue from our largest segment, Regional Brands, increased by 2% to R9 355 million with 7% growth from each of Australasia and the Americas being the major contributors. Excluding the impact of the product divestment in South Africa (R294 million), Regional Brands revenue grew 6% with growth in Africa Middle East of 5% on a comparable product basis.

Gross profit percentage was up at 59,7% (H1 2022: 57,0%), driven by cost of goods savings and favourable sales mix.

Sterile Focus Brands

Revenue from Sterile Focus Brands decreased by 13% to R5 192 million due to the aforementioned challenges in both Russia and China.

Although the gross profit percentage of 60,5% was lower than the prior year comparable period (H1 2022: 61,4%), it is an improved margin compared to the second half of the previous financial year (H2 2022: 59,0%). The cost of goods savings from insourcing production has more than offset higher inflationary and logistic cost pressures.

Manufacturing

Manufacturing revenue decreased by 12% to R4 603 million attributable to the lower COVID vaccine sales. Heparin revenue was impacted by the prioritisation of technical transfer work related to new customers offset by increased pricing to counter the rising cost of raw heparin.

The Manufacturing business has a high fixed cost base and consequently gains and losses of contribution are extremely impactful on profit margins. Gross profit margins were significantly lower at 5,2% (H1 2022: 19,2%), largely impacted by the loss of contribution from the manufacture of the COVID vaccine. This was exacerbated by revenue foregone to facilitate non-revenue generating technical transfer costs needed for the on-boarding of new sterile manufacturing opportunities. The receipt of the grant funding from the Gates Foundation and CEPI helped to partially offset sterile production costs related to the introduction of the Serum Institute of India vaccines.

PROSPECTS

The challenging environment and prioritisation of transferring the manufacture of new sterile products to our facilities was as anticipated and guided for the half. We maintain our guidance that the results for the second half of this financial year will not only exceed those reported for the first half but will also exceed H2 of the prior year. We expect an improved revenue result in both Commercial Pharmaceuticals and Manufacturing in H2 compared to the performance in H2 2022. Manufacturing is anticipated to deliver particularly robust sales growth in the second half, driven by API and Heparin, more than overcoming the loss of the COVID vaccine.

We are also anticipating closure during H2 of important product portfolio enhancement transactions that will strengthen our Commercial Pharmaceutical offering in Latin America and South Africa.

A focus area for the Group has been to fill existing sterile manufacturing capacities. The operating leverage from doing so is significant and is needed to underscore the investment in our sterile platform and deliver the planned returns. We are pleased to announce that we have made significant advances in our contract negotiations for a portion of this capacity. This has given us the confidence to revise the value of the long-term potential contribution that can be achieved from filling available sterile manufacturing capacity upwards from R3 billion to at least R8 billion. We anticipate contribution of R2 billion utilising this capacity in calendar year 2024, increasing to R4 billion in calendar year 2025.

Reported results will receive an uplift should the currently weaker ZAR persist for the balance of this financial year. Reported EBITDA for FY 2023 in line with that delivered in the prior year is being targeted by management. The higher gross profit percentage in Commercial Pharmaceuticals is expected to continue, supported by cost of goods savings. Finance charges will be influenced by the increasing interest rate cycle. Anticipated reduced working capital investment and an operating cash conversion rate of greater than 100% for the financial year should deliver strong cyclical cash flow.

Any forecast information in the abovementioned paragraphs has not been reviewed or reported on by the Group’s auditors and is the responsibility of the directors.

FOR MEDIA PURPOSES:

Click here to access Aspen-related images and broadcast footage

Issued by:

Shauneen Beukes, Aspen Group Communications Consultant

Cell: +27 82 389 8900 | sbeukes@139.224.250.34

Disclaimer

We may make statements that are not historical facts and relate to analyses and other information based on forecasts of future results and estimates of amounts not yet determinable. These are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as “prospects”, “believe”, “anticipate”, “expect”, “intend”, “seek”, “will”, “plan”, “indicate”, “could”, “may”, “endeavour” and “project” and similar expressions are intended to identify such forward-looking statements, but are not the exclusive means of identifying such statements. By their very nature, forward looking statements involve inherent risks and uncertainties, both general and specific, and there are risks that predictions, forecasts, projections and other forward-looking statements will not be achieved. If one or more of these risks materialise, or should underlying assumptions prove incorrect, actual results may be very different from those anticipated. The factors that could cause our actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements are discussed in each year’s annual report. Forward looking statements apply only as of the date on which they are made, and we do not undertake other than in terms of the Listings Requirements of the JSE Limited, any obligation to update or revise any of them, whether as a result of new information, future events or otherwise. Any profit forecasts published in this report are unaudited and have not been reviewed or reported on by Aspen’s external auditors.